Diehl cleaners has the following balance sheet items – Diehl Cleaners presents a comprehensive balance sheet that offers valuable insights into the company’s financial health. This analysis delves into the significance of each balance sheet item, categorizes assets and liabilities, and evaluates shareholders’ equity. By comparing Diehl Cleaners to industry peers and utilizing financial ratios, we gain a comprehensive understanding of the company’s liquidity, solvency, and profitability.

The balance sheet serves as a snapshot of a company’s financial position at a specific point in time, providing a foundation for assessing its overall financial health and performance.

Balance Sheet Analysis

The balance sheet provides a snapshot of a company’s financial health at a specific point in time. It presents the company’s assets, liabilities, and shareholders’ equity.

By analyzing the balance sheet, investors and creditors can gain insights into the company’s liquidity, solvency, and profitability.

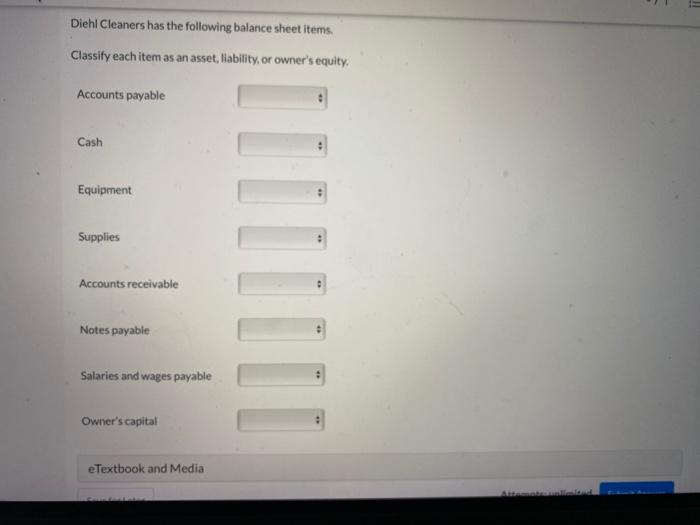

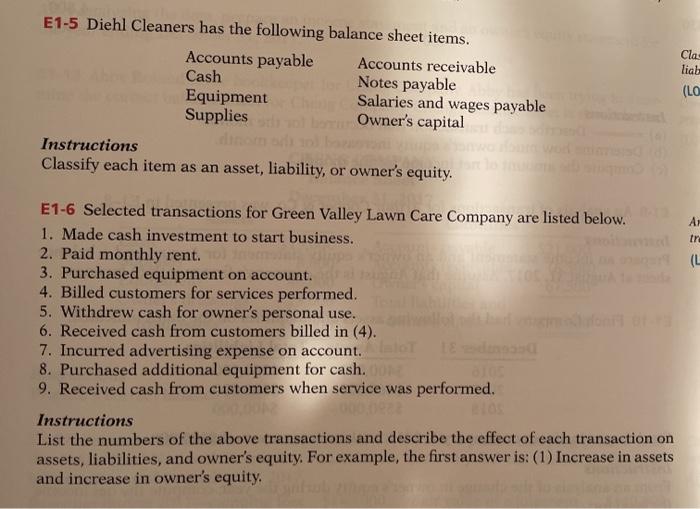

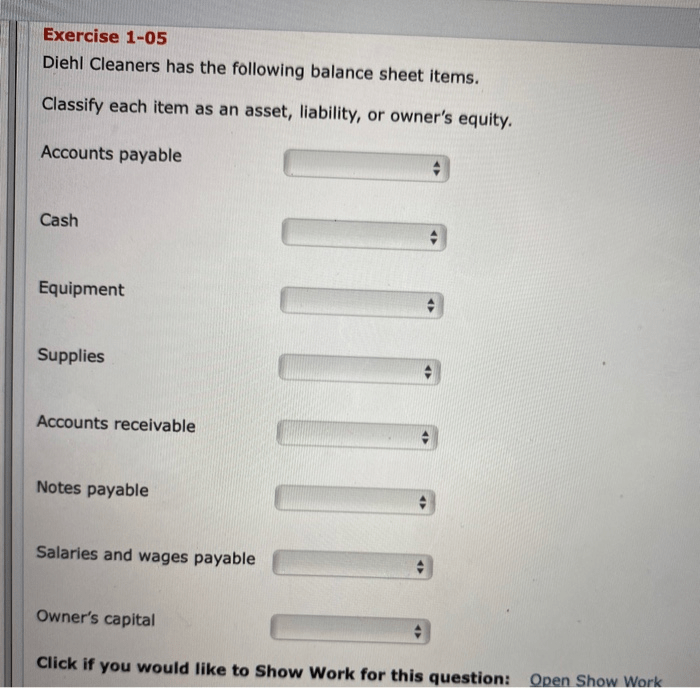

Assets, Diehl cleaners has the following balance sheet items

Assets represent the resources owned by the company. They are classified into current assets and non-current assets.

- Current assets are short-term assets that can be easily converted into cash, such as cash, accounts receivable, and inventory.

- Non-current assets are long-term assets that cannot be easily converted into cash, such as property, plant, and equipment.

Liabilities

Liabilities represent the debts and obligations of the company. They are classified into current liabilities and non-current liabilities.

- Current liabilities are short-term obligations that are due within one year, such as accounts payable and short-term debt.

- Non-current liabilities are long-term obligations that are due more than one year, such as long-term debt and deferred income taxes.

Shareholders’ Equity

Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities. It is calculated as the difference between assets and liabilities.

- Shareholders’ equity can be positive or negative.

- A positive shareholders’ equity indicates that the company has more assets than liabilities, while a negative shareholders’ equity indicates that the company has more liabilities than assets.

FAQ Resource: Diehl Cleaners Has The Following Balance Sheet Items

What is the significance of the balance sheet for Diehl Cleaners?

The balance sheet provides a snapshot of the company’s financial position at a specific point in time, offering insights into its assets, liabilities, and shareholders’ equity.

How can financial ratios be used to evaluate Diehl Cleaners’ performance?

Financial ratios provide valuable metrics for assessing the company’s liquidity, solvency, and profitability, allowing for comparisons to industry benchmarks or historical data.

What are the key considerations for analyzing Diehl Cleaners’ assets and liabilities?

The analysis of assets and liabilities involves identifying and categorizing different types, assessing their composition and liquidity, and evaluating their impact on the company’s financial leverage and solvency.